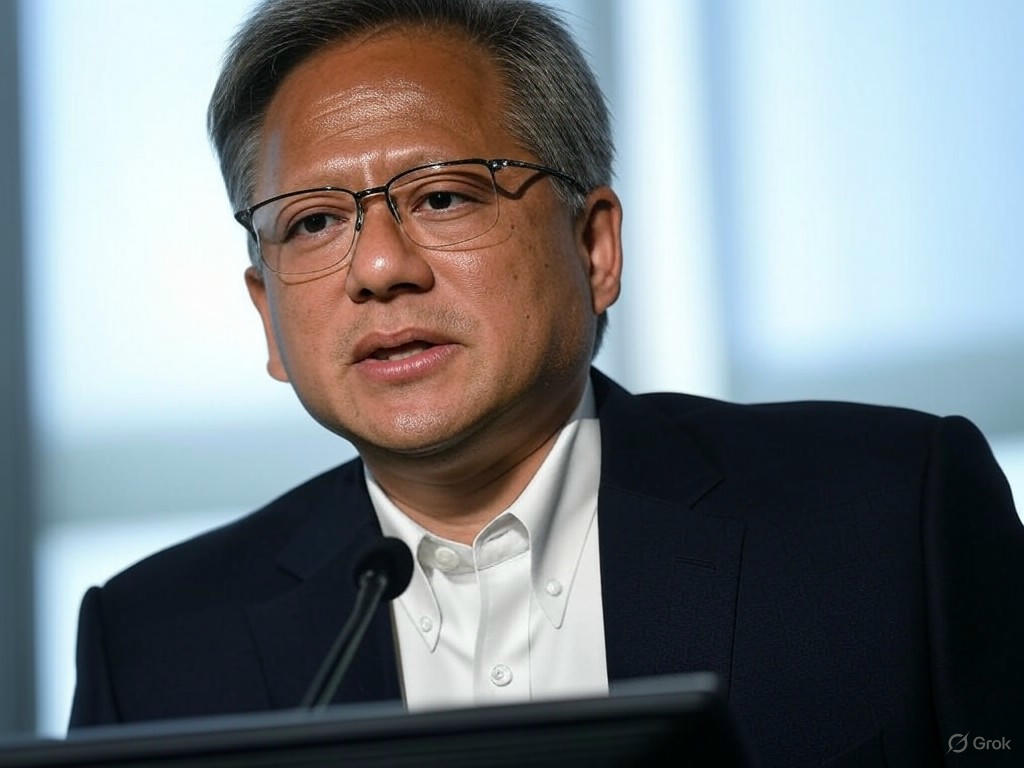

In a surprising yet strategic move, Nvidia, a leading global chipmaker, has announced it will no longer include the Chinese market in its financial projections. This decision, revealed by the company’s CEO during a recent statement, comes as a direct response to stringent US export controls on semiconductor technology to China. The restrictions, aimed at curbing the flow of advanced tech to the Asian powerhouse, have forced Nvidia to recalibrate its business outlook and adapt to a rapidly changing geopolitical landscape.

For years, China has been a significant market for Nvidia, contributing substantially to its revenue through demand for high-performance chips used in gaming, artificial intelligence, and data centers. However, the US government’s tightening grip on technology exports, driven by national security concerns, has created a challenging environment for American tech giants like Nvidia. These policies have limited the company’s ability to sell cutting-edge products in China, prompting a reevaluation of its global strategy. The CEO emphasized that while the decision to exclude China from forecasts was tough, it reflects the company’s commitment to compliance with US regulations and ensuring long-term stability.

The impact of this shift is multifaceted. Financially, Nvidia faces potential revenue gaps as it loses access to one of the world’s largest markets for semiconductors. Analysts predict that this could lead to short-term volatility in the company’s stock as investors reassess growth expectations. However, Nvidia is not standing still. The company is actively seeking to diversify its market presence by strengthening partnerships in other regions, such as Europe and Southeast Asia, where demand for AI and cloud computing solutions continues to soar. Additionally, Nvidia is investing heavily in research and development to create innovative products that can meet the needs of alternative markets while adhering to export guidelines.

Beyond the balance sheet, this development underscores broader tensions in the global tech industry. The US-China tech rivalry has placed companies like Nvidia in a precarious position, balancing profitability with regulatory compliance. Industry experts believe this could set a precedent for other American firms operating in sensitive sectors, potentially reshaping how multinational corporations approach markets under geopolitical strain. For Nvidia, the exclusion of China from its forecasts is not just a financial adjustment but a signal of a new era where business decisions are increasingly intertwined with international politics.

As Nvidia navigates these uncharted waters, the tech world watches closely. The company’s ability to pivot and innovate in the face of adversity will likely determine its trajectory in the coming years. While the Chinese market’s absence from forecasts may sting in the short term, Nvidia’s proactive stance and adaptability could pave the way for sustained growth elsewhere. In an industry defined by rapid change, Nvidia’s latest move is a reminder that resilience and strategic foresight are as critical as the chips they produce.