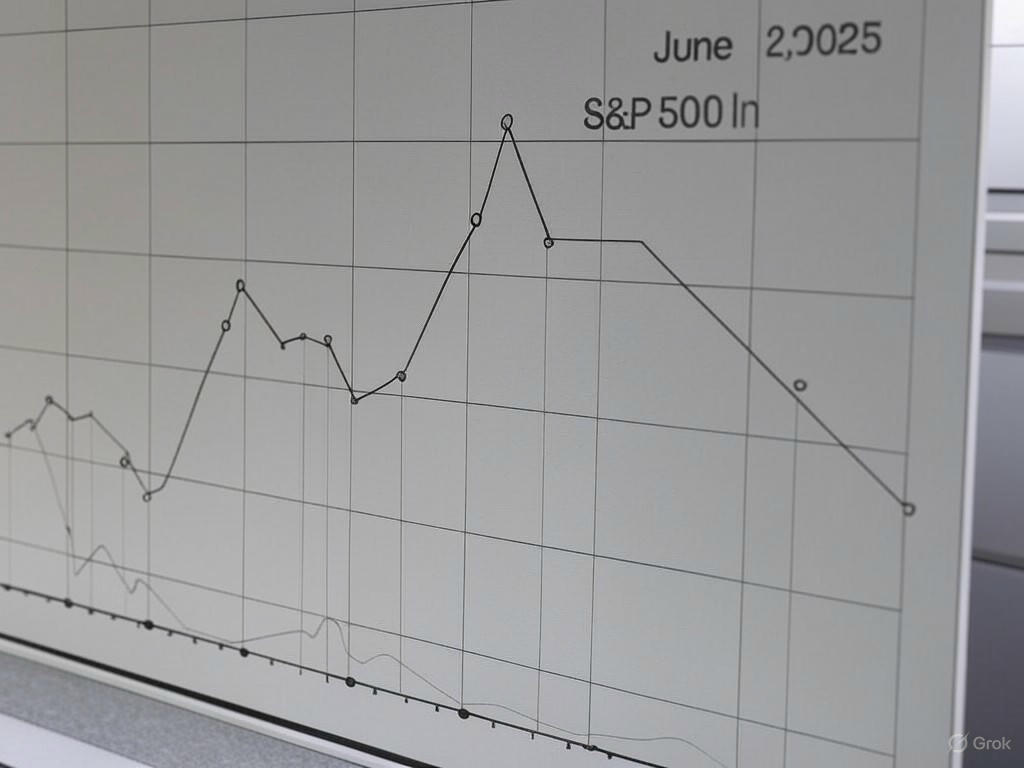

In a remarkable display of market optimism, the S&P 500 shattered the 6,000-point barrier on June 6, 2025, marking its highest level since February. This historic surge, driven by a robust labor market report, has reignited investor confidence at a time when economic uncertainties, including potential tariff impacts, have loomed large. The milestone reflects a broader rally across Wall Street, with major indices posting significant gains and companies like Tesla bouncing back from recent sell-offs.

The catalyst for this upward momentum was the release of the much-anticipated monthly jobs report, which painted a picture of resilience in the U.S. economy. Despite ongoing debates over trade policies and their potential to disrupt global supply chains, the data showcased steady job growth and a stable unemployment rate. Investors interpreted these figures as a sign that the economy could withstand external pressures, prompting a wave of buying activity. Technology and automotive sectors, in particular, saw renewed interest, with Tesla shares climbing sharply after weeks of volatility. Analysts noted that the electric vehicle giant’s recovery signals growing faith in innovation-driven industries, even amidst market fluctuations.

Market sentiment was further bolstered by a sense of relief that the labor market remains a pillar of strength. Economists had feared that rising costs and geopolitical tensions might dampen hiring, but the latest numbers suggest businesses are still expanding their workforces. This has alleviated some concerns about a potential slowdown, although experts caution that challenges remain on the horizon. Tariffs, for instance, continue to be a wildcard, with their long-term effects on corporate profits and consumer prices still unclear. Nevertheless, the immediate reaction from traders was overwhelmingly positive, with trading volumes spiking as the S&P 500 crossed the symbolic 6,000 threshold.

Individual stories of corporate success also contributed to the day’s bullish tone. Tesla, which had faced a steep sell-off in prior weeks due to concerns over production delays and competitive pressures, staged an impressive comeback. Investors appear to be betting on the company’s long-term vision, with renewed focus on its advancements in sustainable energy and autonomous driving technology. Other sectors, including financials and consumer goods, also rode the wave of optimism, reflecting a broad-based recovery in market confidence.

As the dust settles on this landmark day for the S&P 500, questions linger about the sustainability of this rally. While the jobs report has provided a much-needed boost, external factors such as inflation, interest rate decisions, and international trade dynamics will continue to test the market’s resilience. For now, though, Wall Street is basking in the glow of a hard-earned achievement, with the 6,000-point mark serving as a testament to the enduring strength of the U.S. economy. Investors and analysts alike will be watching closely in the coming weeks to see if this momentum can hold, or if new hurdles will emerge to challenge the market’s newfound heights.