Market Jitters: S&P 500 Wavers Amid Renewed Tariff Tensions

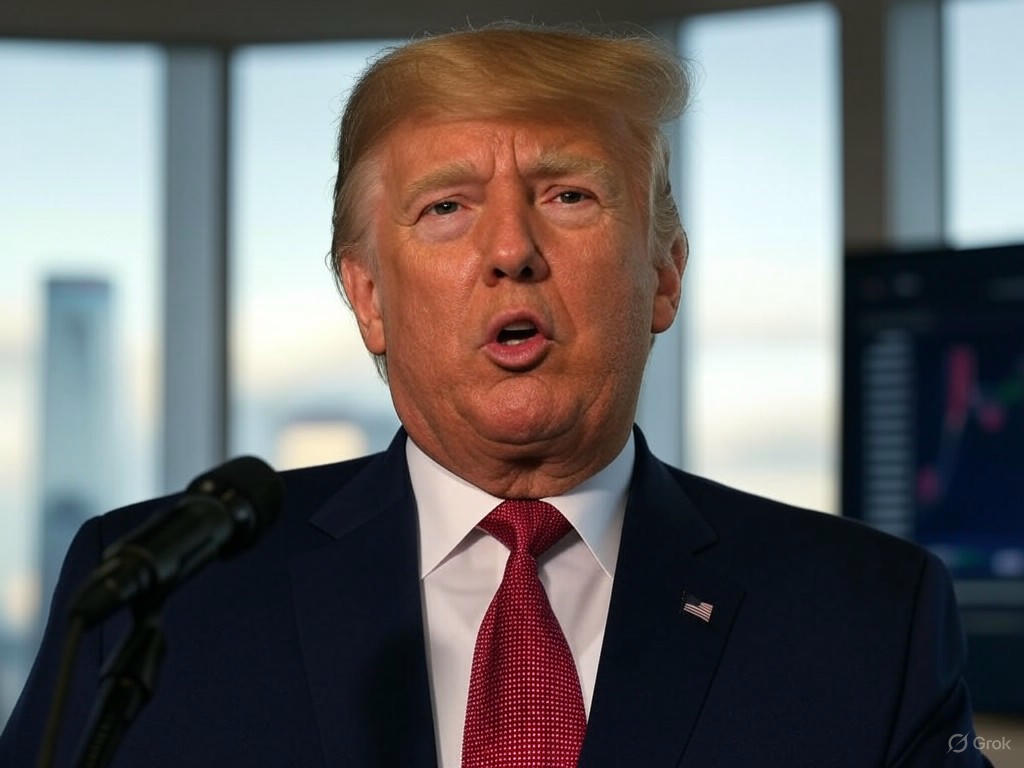

The financial markets are once again on edge as the S&P 500 Index experienced a day of uneven trading, hovering between minor gains and losses. Investors seemed to brush aside encouraging economic data, including a recent report indicating a slowdown in inflation, and instead focused on the rekindled specter of trade disputes. The latest trigger for uncertainty stems from renewed threats of unilateral tariffs, echoing past tensions that have historically rattled Wall Street. This development, tied to comments from former President Donald Trump, has reignited fears of disrupted global trade dynamics, particularly with key economic partners like China.

As the trading session unfolded, market participants appeared largely unmoved by ongoing discussions between the United States and China aimed at easing trade frictions. These talks, while significant, failed to provide the reassurance investors sought, leaving many to speculate on the potential economic fallout of new tariff impositions. Analysts note that such policies could lead to higher costs for American consumers and businesses, as well as retaliatory measures from trading partners, further complicating the global supply chain. The S&P 500’s tepid performance reflects this cautious sentiment, with many traders adopting a wait-and-see approach rather than making bold moves.

The broader economic backdrop adds another layer of complexity to the situation. While inflation appears to be cooling—a factor that typically boosts market optimism—the uncertainty surrounding trade policies has overshadowed this positive signal. Investors are keenly aware that tariffs could reignite inflationary pressures by increasing the cost of imported goods, potentially offsetting recent gains in price stability. Moreover, sectors heavily reliant on international trade, such as technology and manufacturing, felt the brunt of the uncertainty, with some stocks in these industries showing particular volatility during the trading day.

Market experts are now weighing in on what this means for the future. Some believe that the tariff rhetoric may be more political posturing than imminent policy, suggesting that the actual implementation of such measures remains uncertain. Others warn that even the threat of tariffs can have a chilling effect on business confidence, prompting companies to delay investments or adjust their supply chains preemptively. This could have a ripple effect across the economy, impacting everything from corporate earnings to consumer spending.

As the week draws to a close, all eyes remain on Washington and any further developments regarding trade policy. The S&P 500’s fluctuations serve as a reminder of the delicate balance between economic data and geopolitical rhetoric in shaping market sentiment. For now, investors are bracing for potential turbulence, hoping for clarity on the trade front while navigating an already complex financial landscape. Whether these tariff threats materialize or fade into the background, their impact on market psychology is undeniable, leaving Wall Street in a state of cautious anticipation for what lies ahead.