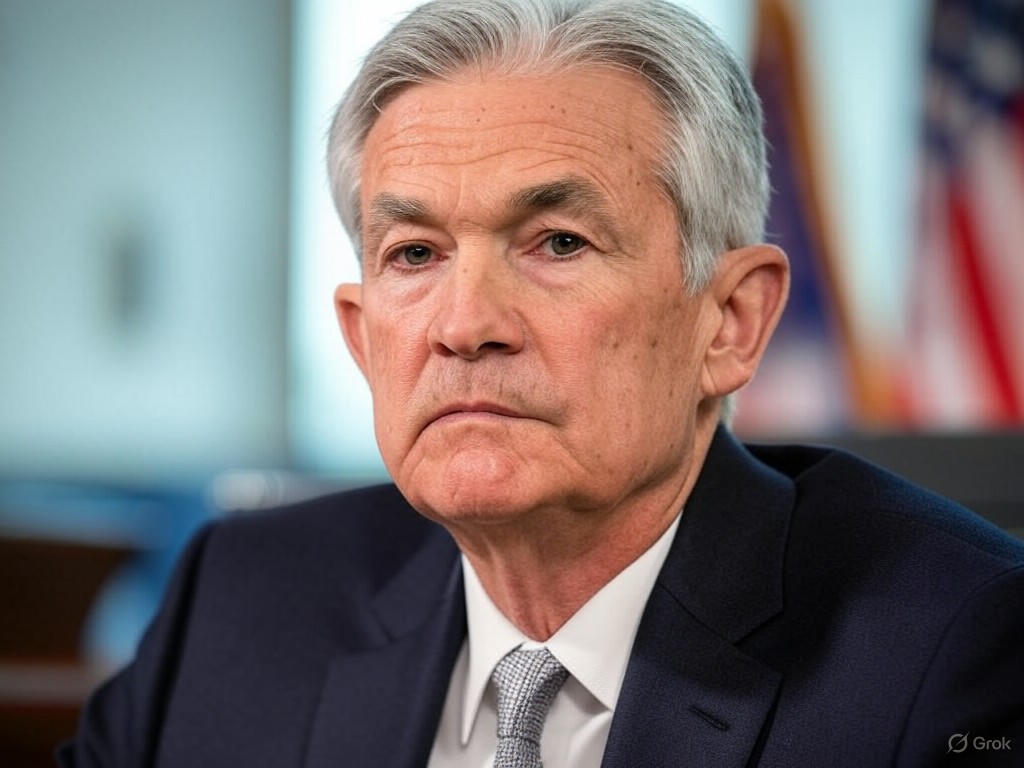

Federal Reserve Stands Firm: Powell Prioritizes Inflation Control Amid Political Backlash

In a recent public address, Federal Reserve Chairman Jerome Powell reiterated the central bank’s unwavering commitment to curbing inflation, even as political tensions simmer. Powell emphasized that the Fed’s primary responsibility is to maintain economic stability, a duty that transcends external pressures or criticism. His remarks come at a time when inflation remains a pressing concern for households and businesses alike, with rising costs impacting everything from groceries to energy bills. Despite the risk of further straining relations with political figures, Powell’s focus on preventing what he termed a ‘persistent inflation challenge’ signals the Fed’s determination to prioritize long-term economic health over short-term appeasement.

The backdrop to Powell’s comments is a growing chorus of disapproval from former President Donald Trump, who has repeatedly voiced frustration with the Fed’s policies. Trump has criticized Powell for what he perceives as overly cautious or restrictive measures, arguing that they hinder economic growth. This ongoing feud highlights a broader tension between political leaders seeking rapid results and a central bank tasked with balancing growth and stability. Yet, Powell appears undeterred, stressing that allowing inflation to spiral unchecked could lead to far graver consequences for the economy. He pointed to historical examples where unchecked price surges eroded consumer confidence and destabilized markets, underscoring the need for proactive measures like interest rate adjustments, even if they invite scrutiny.

Powell’s stance also reflects the Fed’s broader strategy to navigate a complex economic landscape. With global uncertainties and domestic challenges mounting, the central bank faces the delicate task of tightening monetary policy without triggering a recession. Analysts note that while higher interest rates may slow growth in the short term, they are a critical tool for reining in inflation. Powell acknowledged the hardships these policies might impose on some sectors, but argued that the alternative—allowing inflation to become entrenched—would be far more damaging. His remarks serve as a reminder that the Fed operates with an eye on sustainable progress, not immediate political wins. As the debate over the Fed’s role intensifies, Powell’s resolve suggests that the central bank will continue to chart its course based on data and economic principles, rather than external noise. This approach, while potentially divisive, reinforces the Fed’s independence, a cornerstone of its ability to make tough decisions in turbulent times.

Looking ahead, the friction between the Fed and its critics is unlikely to dissipate soon. Political pressures may grow as the effects of monetary tightening become more pronounced, particularly if economic slowdowns or job losses follow. However, Powell’s latest statements make it clear that the Federal Reserve remains focused on its mandate. By doubling down on the fight against inflation, even in the face of vocal opposition, the Fed is signaling that it will not shy away from difficult choices. For now, Powell’s message is resolute: safeguarding the economy from the perils of unchecked inflation is a non-negotiable priority, no matter the political cost.