The Unraveling of a Media Giant: Why Warner’s Empire Faces Division

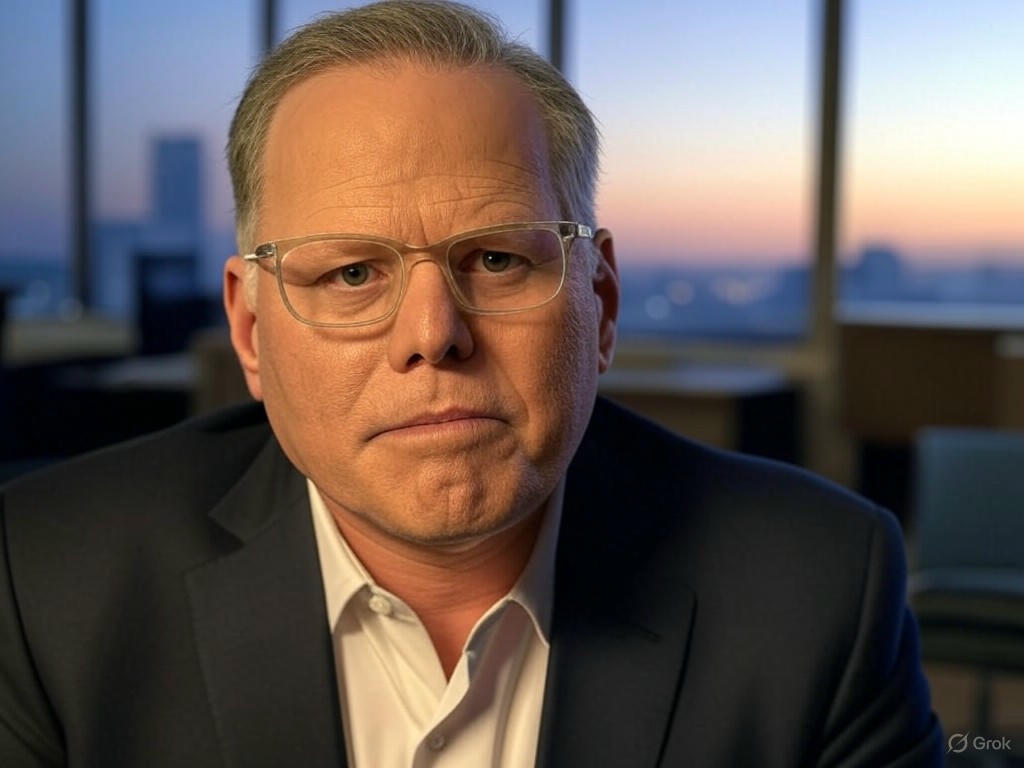

In the ever-shifting landscape of media and entertainment, few stories have captured attention like the potential breakup of Warner’s sprawling empire under the leadership of CEO David Zaslav. Once hailed as a visionary for merging Warner Bros. with Discovery in a blockbuster deal, Zaslav now finds himself at a crossroads, compelled to consider dismantling the very conglomerate he painstakingly built. The pressures of a rapidly changing industry, coupled with financial strains and strategic missteps, have led to whispers of a split that could redefine the future of one of Hollywood’s most iconic names.

The journey to this pivotal moment began with high hopes. The 2022 merger of Warner Bros. and Discovery was pitched as a game-changer, combining Warner’s storied film and television assets with Discovery’s robust portfolio of reality and lifestyle content. The goal was to create a powerhouse capable of competing with streaming giants like Netflix and Disney. Under Zaslav’s stewardship, the new entity, Warner Bros. Discovery, aimed to streamline operations, cut costs, and invest heavily in a unified streaming platform, Max. However, the reality has been far messier. The media landscape has proven unforgiving, with declining traditional TV revenues, fierce streaming competition, and a debt burden from the merger weighing heavily on the company’s balance sheet. Investors have grown restless, and the stock price has faltered, prompting tough questions about the sustainability of the current structure.

Several factors are driving the conversation around a potential breakup. For one, the diverse nature of Warner Bros. Discovery’s assets—from blockbuster films and HBO’s prestige dramas to Discovery’s unscripted programming—has made synergy harder to achieve than anticipated. While the idea of cross-pollination between content types sounded promising, execution has been uneven. Additionally, the streaming wars have intensified, with competitors pouring billions into original content while Warner Bros. Discovery struggles to balance quality with cost-cutting measures. Some industry analysts argue that splitting the company into more focused entities—perhaps separating the entertainment arm from the factual content division—could unlock value and allow each segment to thrive independently. Others point to the possibility of selling off underperforming assets to alleviate debt and refocus on core strengths like cinematic storytelling.

As Zaslav navigates these turbulent waters, the stakes couldn’t be higher. A breakup, if it happens, would mark a dramatic reversal of his initial vision and could reshape the media industry yet again. Employees, shareholders, and fans alike are watching closely, aware that the decisions made in the coming months will echo for years. Whether Warner Bros. Discovery emerges as a leaner, more agile competitor or fades under the weight of its ambitions remains to be seen. For now, Zaslav’s legacy hangs in the balance, a reminder of how quickly fortunes can shift in the high-stakes world of media empires.