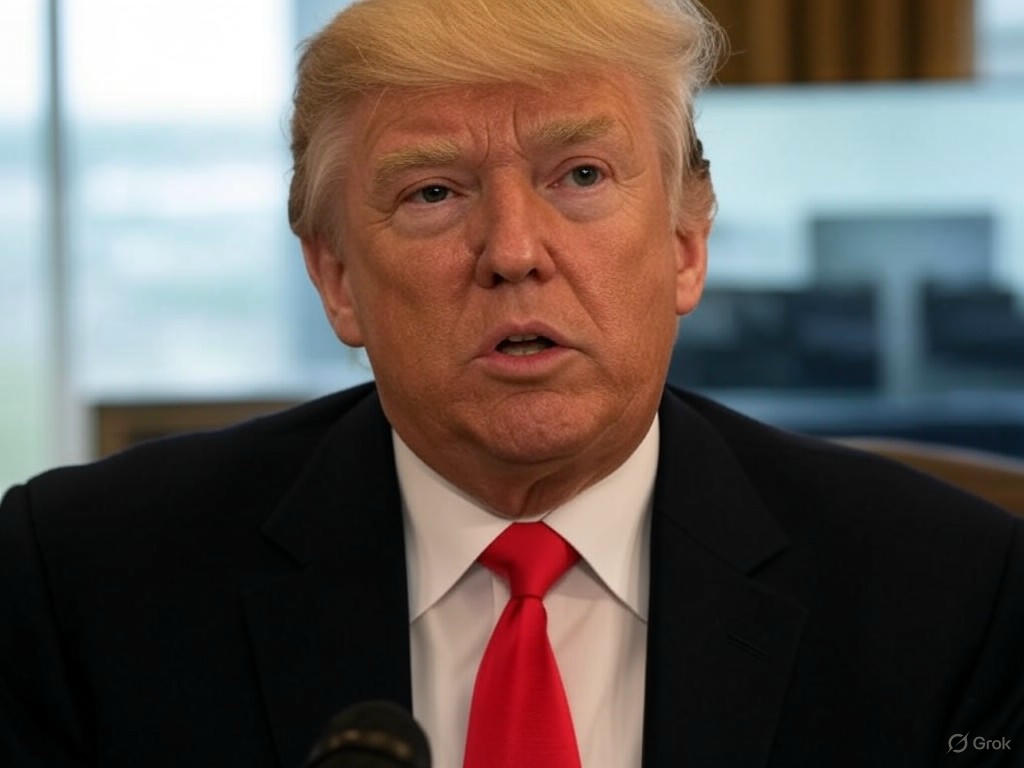

Trump Media’s Bold Move: $400 Million Stock Buyback Signals Confidence

In a striking display of financial strategy, Trump Media and Technology Group has unveiled a significant plan to repurchase up to $400 million of its own shares. This announcement, made public from their Sarasota, Florida headquarters, underscores the company’s belief in its long-term value and its commitment to enhancing shareholder returns. The decision, approved by the board of directors, comes at a time when the media and tech conglomerate is navigating a highly competitive digital landscape, seeking to solidify its position as a major player.

The stock buyback program is a clear signal of optimism from Trump Media’s leadership. By allocating such a substantial sum to repurchase shares, the company aims to reduce the number of outstanding shares in the market, potentially boosting the stock price and increasing earnings per share for remaining investors. This move is often interpreted as a vote of confidence in the company’s future prospects, suggesting that executives believe the current market value underestimates the firm’s intrinsic worth. For a company like Trump Media, which operates in the volatile world of digital content and technology, this could also be a strategic effort to stabilize stock performance amid fluctuating investor sentiment.

Moreover, the timing of this buyback is noteworthy. As the digital media sector faces challenges like evolving consumer preferences and intense competition from established giants, Trump Media appears to be doubling down on its vision. The company, known for its association with high-profile political figures and its focus on alternative social platforms, may be using this financial maneuver to reassure stakeholders of its resilience. Analysts suggest that repurchasing shares could also provide the firm with greater flexibility to fund innovation or acquisitions without diluting existing shareholders’ stakes.

However, not all market observers are convinced that this is a foolproof strategy. Some caution that large-scale buybacks can strain a company’s cash reserves, potentially limiting funds available for research, development, or other growth initiatives. If the anticipated boost in stock price fails to materialize, or if market conditions worsen, Trump Media could face criticism for prioritizing short-term gains over long-term stability. Despite these concerns, the scale of the $400 million authorization indicates a calculated risk, one that the company’s leadership seems prepared to take.

As Trump Media moves forward with this ambitious plan, the business world will be watching closely. Will this buyback prove to be a masterstroke that propels the company to new heights, or will it be a misstep in an already unpredictable industry? For now, the announcement has sparked renewed interest in the firm’s trajectory, drawing attention to its unique blend of media influence and technological ambition. With $400 million on the line, Trump Media is making a bold statement: it’s here to stay, and it’s betting big on its own success.